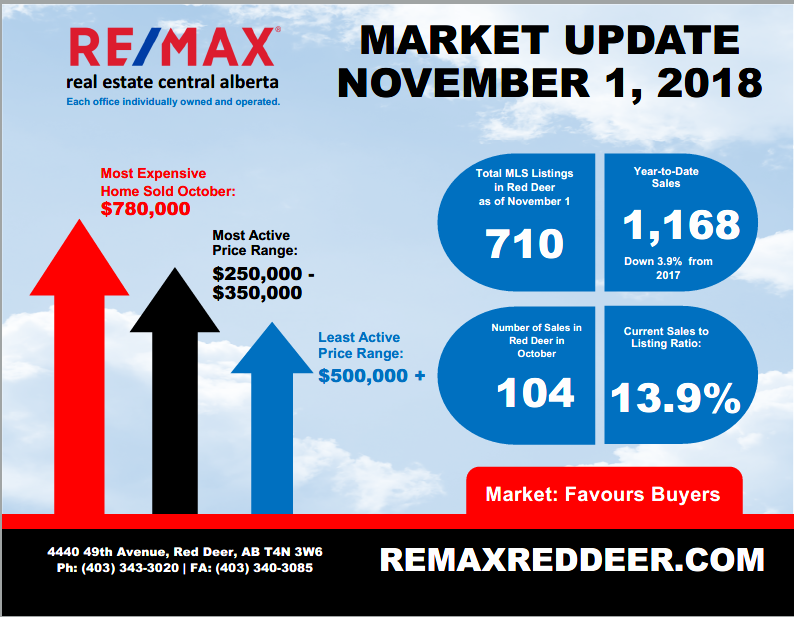

MARKET UPDATE – November 1, 2018

November 21st, 2018There are a number of economic indicators that suggest the Alberta economy is gradually recovering from the downturn that started in January 2015 when oil prices began to free fall. Alberta Treasury Branch economic updates over past weeks have highlighted a return to population growth, increased employment, strong vehicle sales, growing restaurant receipts and higher wages as proof that we are making gains.

In the past forty years Alberta has experienced at least five economic reverses, some more drastic than others. Many who can remember the early eighties believe this most recent one to be almost as bad. The common denominator is that we always recover to even better times, although this recovery has been slower than most simply because oil prices were depressed for longer.

The improving economy hasn’t translated to the real estate market yet, but it too will recover. The question on every seller’s mind is when? The simple economic principle of Supply and Demand provides the answer. When Supply and Demand are balanced, prices will stabilize. When Demand outpaces Supply, prices will go up. In the meantime, buyers have an unprecedented opportunity to take advantage of ample choice and very attractive prices.

MARKET UPDATE – October 15, 2018

November 21st, 2018MARKET UPDATE – October 1, 2018

November 21st, 2018Consumer confidence is one of the most important ingredients in a healthy real estate market and it’s been mostly missing since oil prices collapsed in January 2015. There has been some good news in the last year… oil prices back up to +$70US along with government assurances that the economy is on the mend, but every piece of good news has been negated by ongoing delays in pipeline development (that would reduce the discount on the price of Alberta oil) and the federal government’s inability to finalize a new North American Trade Agreement.

Those issues don’t directly impact every central Albertan, but they have been nagging issues in the backs of our minds and quite likely contributed to slower sales this year. The September market didn’t get any help from the weather either, which moved directly from summer to winter.

Good news! We have a new North American Free Trade Agreement as of Oct. 1st and we almost certainly have a massive new Liquefied Natural Gas project for Kitimat, B.C. that will put $40 Billion into the Alberta and B.C. economies. Those are huge confidence boosters that we believe can make a long term, positive impact on consumer confidence and the housing market. It won’t happen tomorrow, but maybe we’ve finally turned the corner.

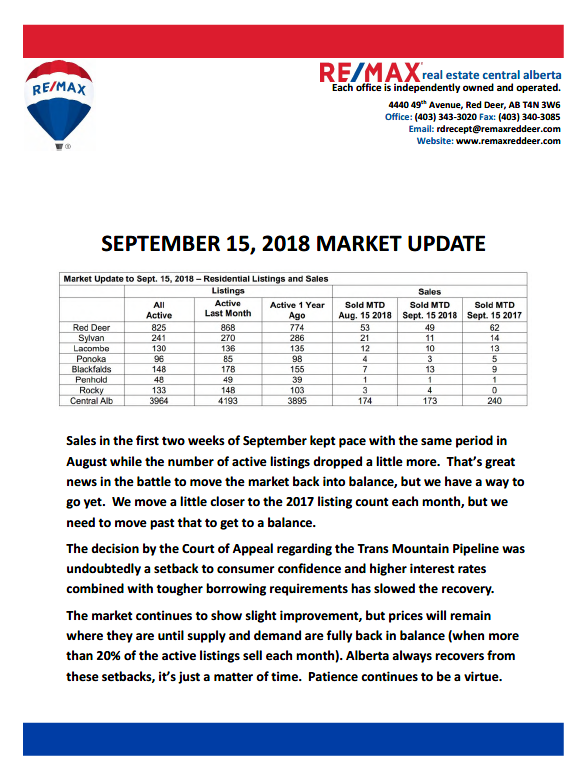

MARKET UPDATE – September 15, 2018

November 21st, 2018MARKET UPDATE – September 1, 2018

September 19th, 2018In spite of the heat and smoke, August turned out quite nicely in Red Deer, Lacombe, Sylvan Lake and Blackfalds with stronger than expected sales. At the same time the number of active listings continued their downward trend, pushing supply and demand slightly closer to balance. Ponoka, Rocky Mountain House and Penhold didn’t experience the same sales activity, but the number of active listings did come down slightly. Unfortunately, we have a long way to go to get the market back to balance and prices will remain depressed until then.

For the last three and a half years the Alberta real estate market has experienced excess inventories, slow sales and declining prices. Any gains we should have made from the economic recovery have been offset by crippling changes the federal government applied to mortgage qualifying rules.

Will the ongoing challenges to construction of the Trans Mountain Pipeline will affect the real estate market? The simple answer is yes, but it’s important to note there is still hope that the issues can be resolved. The Federal Government is heavily invested in this project both politically and financially and must find a solution.

MARKET UPDATE – August 15, 2018

August 22nd, 2018MARKET UPDATE – July 1, 2018

July 12th, 2018June sales in central Alberta were down compared to May in most central Alberta markets except Red Deer, which managed a slight increase. In that time the number of active listings has experienced slight increases in some markets and slight decreases in others.

There are several big picture issues that are influencing the real estate market in Alberta, positive and negative. On the positive side, oil prices are up again and there appears to be some good news on the pipeline front – Kinder Morgan still in progress rather than stopped completely, Enbridge’s Line 9 has received further approvals in the U.S (although there are still some regulatory hurdles) and even the long-delayed Keystone appears to be making headway. And, for the first time in three years, Alberta experienced a positive net interprovincial population increase in the first quarter of 2018.

On the negative side, the escalating trade war between Canada and the U.S. is causing some real financial stress for some, but more importantly, anxiety and a loss of confidence on the part of many Canadians. That loss of confidence causes people to hesitate when it comes to large decisions, one of the most important being home purchases. We do believe the market may have bottomed out with better prospects for the balance of the year on the assumption that the trade issue doesn’t escalate further.

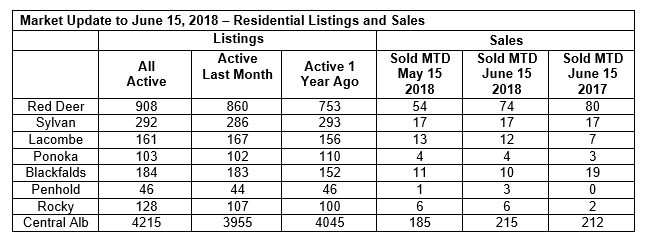

MARKET UPDATE – June 15, 2018

June 20th, 2018May was a funny month and we are sure that the deadline imposed on the Kinder Morgan pipeline caused some consumer anxiety and was a major factor in a bit slower market. Inventories in some markets continued to climb while the number of sales was off in most markets. There has been an improvement in sales in most markets in the first two weeks of June and it appears that the inventory increases are beginning to moderate. We are forecasting the market will move slightly closer to balance in the last half of 2018 as economic activity continues to improve in Alberta.

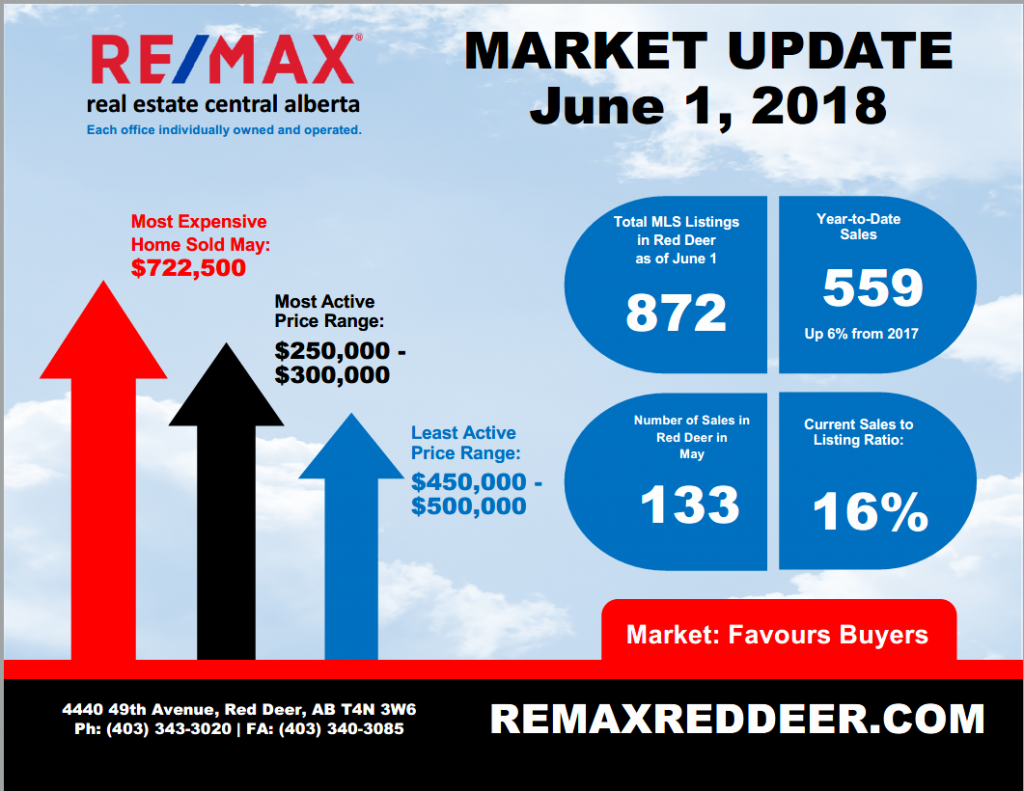

MARKET UPDATE – June 1, 2018

June 15th, 2018May sales were up slightly in some central Alberta markets and off slightly in others. Concern over the Kinder Morgan deadline may have impacted consumer confidence negatively, causing sales to slow slightly compared to last month. We believe it is more likely the pipeline will be completed under federal government ownership and if the general public feels the same way, consumer confidence will rise, and more people will consider buying their first home or moving up.

The statistic that is most affecting our markets now is the number of active listings which continues to rise in almost every market we serve. The increase is most dramatic in Red Deer and Sylvan Lake where the active listing count has reached an all time high. Almost all our central Alberta markets have historically high listing counts.

There are positives and negatives that come with high listing counts. The positive for buyers is ample choice and the negative for sellers is it keeps prices in check. Prices have fallen significantly in the past 3 years and while the market is starting to show signs of improvement, it is likely to take more time before sellers can expect to see prices start to recover. With less than 2 out of every 10 listings selling each month, a price that reflects our current reality is the most important ingredient for a successful sale.